Become a member at OnPoint

It’s been over 90 years since a handful of schoolteachers joined together to form our credit union. They didn’t do it for profit. They did it to help one another. After all, that’s what community is all about.

GET STARTED

Who can join—membership eligibility.

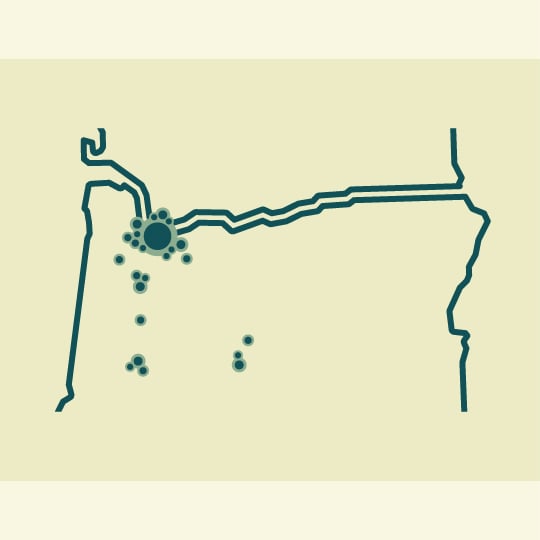

We’re excited you’re considering becoming an OnPoint member, and with 57 branches in Oregon and SW Washington, joining has never been easier!

You’re eligible for membership if you meet any one of the following criteria:

Oregon

You live or work in any of the counties we serve, or you’re a family member of a person who is eligible for OnPoint membership. The 28 counties we serve in Oregon: Benton, Clackamas, Clatsop, Columbia, Coos, Crook, Curry, Deschutes, Douglas, Gilliam, Hood River, Jackson, Jefferson, Josephine, Klamath, Lane, Lincoln, Linn, Marion, Morrow, Multnomah, Polk, Sherman, Tillamook, Wasco, Washington, Wheeler, or Yamhill.

Washington

You live, work, worship or go to school in any of the counties we serve, or you’re a family member of a person who is eligible for OnPoint membership. The 2 counties we serve in Washington: Clark and Skamania.

Membership & Account Agreement

Code of Conduct for Engaging with OnPoint

Open an account today

What you'll need to apply online:

- Be a legal U.S. resident

- Be at least 18 years old (To open a youth membership, please visit an OnPoint branch.)

- Have a Social Security number

- Have a debit or credit card to fund your account(s)

- Have a government issued ID (Driver's License, State ID card, Passport. Permanent Resident Card, Military ID card)

Our story

Serving people in our region since 1932. Community focused. Member owned.

Our roots

In 1932, 16 schoolteachers got together to create a safe place to save their money and provide low-cost loans to other teachers and their families. They named it Portland Teachers Credit Union.

Our growth

As our community grew, we grew right along with it. In 2005, we were granted a community charter in Oregon and Southwest Washington, allowing us to expand our field of membership. To reflect this growth, we changed our name to what you know us as today, OnPoint Community Credit Union.

Our commitment

OnPoint has been improving the lives of our members and the communities we serve—including Portland, Vancouver, Eugene and Bend—for 90 years. In that time, we’ve grown to be the largest member-owned financial institution headquartered in Oregon with more than 563,000 loyal members.

A better banking experience with OnPoint digital banking.

OnPoint’s intuitive digital banking platform is designed to provide a seamless and user-friendly experience, making it effortless for you to manage your finances from anywhere with ease. Whether you’re accessing funds, transferring money, paying bills, or monitoring your accounts, our digital banking platform offers a straightforward interface that simplifies your financial tasks. With just a few clicks, you can navigate through various banking features and access the information you need, empowering you to stay in control of your financial well-being.

Open an account online

Digital banking features

- Account management & updates

- Person-to-person payments

- Finance manager

- Text & email alerts

- Secure account access

- Touch ID & face ID

- Customizable experience

- Mobile deposits

- Bill payments and digital transfers

- eStatements

Become a member today!

Open an account onlineDisclosures

By submitting this form, you agree to OnPoint’s collection and use of the information you provide in accordance with our privacy notice and online privacy policy available here. You also confirm that any information you submit is your own and that you are at least 18 years of age.

If you would prefer to submit your application via mail, please contact us at 800.527.3932.

Consumer Membership & Account Agreement

Business Membership & Account Agreement