Join OnPoint

Community banking and so much more. Unlock what's possible.

It’s been nearly 90 years since a handful of schoolteachers joined together to form our credit union. They didn’t do it for profit. They did it to help one another. After all, that’s what community is all about.

Excellent rates & member value

Member-owned & community-focused

Extensive ATM & branch network

Dependable & secure access

Who can join—membership eligibility.

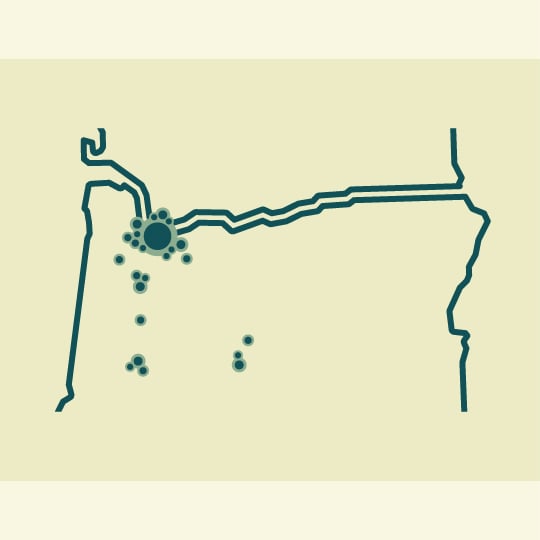

We’re excited you’re considering becoming an OnPoint member, and with 55 branches in Oregon and SW Washington, joining has never been easier!

You’re eligible for membership if you meet any one of the following criteria:

Oregon

You live or work in any of the counties we serve, or you’re a family member of a person who is eligible for OnPoint membership. The 28 counties we serve in Oregon: Benton, Clackamas, Clatsop, Columbia, Coos, Crook, Curry, Deschutes, Douglas, Gilliam, Hood River, Jackson, Jefferson, Josephine, Klamath, Lane, Lincoln, Linn, Marion, Morrow, Multnomah, Polk, Sherman, Tillamook, Wasco, Washington, Wheeler, or Yamhill.

Washington

You live, work, worship or go to school in any of the counties we serve, or you’re a family member of a person who is eligible for OnPoint membership. The 2 counties we serve in Washington: Clark and Skamania.

View our Consumer Membership & Account Agreement

Open an account online

What you'll need to apply online:

- Be a legal U.S. resident

- Be at least 18 years old (To open a youth membership, please visit an OnPoint branch.)

- Have a Social Security number

- Have a debit or credit card to fund your account(s)

- Have a government issued ID (Driver's License, State ID card, Passport. Permanent Resident Card, Military ID card)

Credit unions are different. OnPoint takes it further.

People are the Point.

Money without people is just money. It doesn’t roll up its sleeves to get things done. It doesn’t have a story, or dream big. OnPoint understands that it takes people to run a business, or turn a house into a home. And it takes people to build and support a thriving community.

People helping people.

We live in an inspiring community full of remarkable people and organizations working every day to make it special. We’re a member-owned, local community credit union empowering you to get the most out of your life through personalized banking service, comprehensive financial solutions and community impact.

People are the Point.

Learn more and be a part of our giving story.

Danika L.Never been happier! Switched all accounts to OnPoint from a bank that we were with for over 20 years.

A leading community lender

In 2020, we helped fuel our local economy by financing over $3.5 billion in affordable loans to members.

No gimmicks, no tricks

We’re here to serve you, not the other way around. We’re not-for-profit, so our first priority is always you.

Dedicated to giving back

As a local community credit union, we give back to causes and organizations that make a difference in the place we call home.

OnPoint vs. banks

Type of organization

Type of organization

Who can join

Who can join

Invested in

Invested in

Deposits federally insured by

Deposits federally insured by

Governance

Governance

Interactions with like financial institutions

Interactions with like financial institutions

OnPoint

Type of organization

Not-for-profit – Fewer fees, better rates

As a not-for-profit financial cooperative, we return our profits to our members in the form of better rates, lower fees and greater service.

Who can join

Members

OnPoint’s membership is open to anyone in the communities we serve, including the family of eligible members.

Invested in

Community and members

We serve the needs of our membership and community by investing our non-interest income and interest from loans in local organizations working to make a difference.

Deposits federally insured by

NCUA insured ($250k)

Your deposits are insured by the National Credit Union Administration (NCUA) and are backed by the full faith and credit of the United States government.

Governance

Member owned

Every OnPoint member has a voice. Our Board of Directors are directly elected by members and offer guidance and expertise that benefit our entire membership base.

Interactions with like financial institutions

Cooperative

Credit Unions are financial cooperatives. That means we work together toward one common goal—helping our members prosper.

Banks

Type of organization

For-profit – More fees, worse rates

Traditional banking institutions primarily focus on generating profits for their shareholders with no added benefit to their customers.

Who can join

Customers

You cannot join a bank, but anyone can be a customer.

Invested in

Generating revenue

Banks use the income they generate from fees, interest, business accounts and investments to increase their shareholders’ earnings.

Deposits federally insured by

FDIC insured ($250k)

At a bank, your deposits are insured by the Federal Deposit Insurance Corporation and are backed by the full faith and credit of the United States government.

Governance

Shareholder owned

Banks are governed by their shareholders, voting rights depend on the number of shares you own leaving regular customers out of decisions.

Interactions with like financial institutions

Competitive

Banks are competitive. They compete with one another for your business and see you only as a number.

Open a business membership with OnPoint.

Your business banking partner should be as focused on your future as you are—we know that you wear a lot of hats, so we do what we can to help make running your business as smooth as possible. With custom-tailored financing and easy-to-use tools, OnPoint makes banking easier, so you can get back to business.

Open your new business account at your nearest OnPoint location

Here's what you'll need at your business membership appointment.

Review the list of required documents for opening a Business Membership in Oregon and Washington.

We look forward to working with you.

Better banking, more impact. Become a member today.

Disclosures

If you would prefer to submit your application via mail, please print out and complete our paper membership application. Mail your completed application to: Member Services, PO Box 3750, Portland, OR 97208. Include a $5 check, which will establish your OnPoint membership with a minimum balance of $5.

Consumer Membership & Account Agreement

Business Membership & Account Agreement