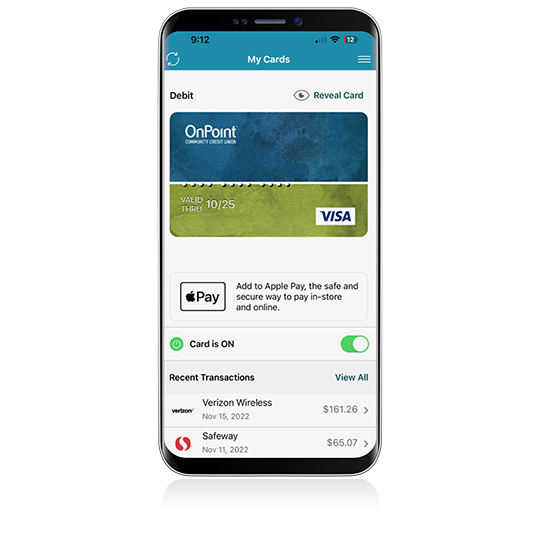

Card Manager App

What is the card manager app?

Conveniently located in your digital banking, the card manager app is the single place to get, use and manage your debit cards.

Manage your card on your terms.

Turn your debit card on/off

You can turn your debit card off if it’s been lost, misplaced, or stolen. Then, if you find it, turn it back on just as quickly.

Set up controls and alerts

Manage your debit card notifications on your terms.

Access digital wallet and support 24/7

Easily add your card to your mobile wallet, online stores and monthly subscriptions

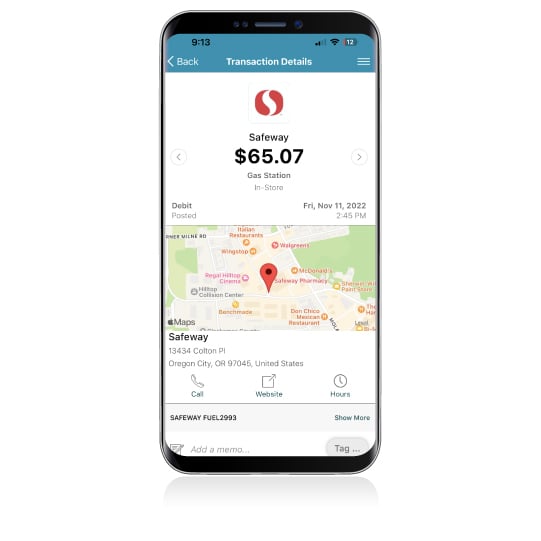

Manage your spending

Track where you are using your card to better understand your spending.

Travel securely

Notify us when you’re traveling to use your card seamlessly.

Create custom merchant lists

Set specific areas or merchants where your card will work to avoid unplanned transactions.

How to access card manager features.

Follow four easy steps and unlock your new and improved card experience.

- Log into Digital Banking.

- Select Services from the main menu.

- Select Card Manager.

- Follow the prompts to enroll and download the OnPoint Card Manager app.

Card Manager FAQs

Browse or search all Card Manager FAQs.