Financial education for teaching in Oregon

Meet your financial literacy curriculum goals.

The courses, resources and tools provided on this page have been selected by OnPoint to support educators building a curriculum that corresponds with the State of Oregon High School Financial Literacy Standards. Select a link below to jump to the individual standard you would like to explore.

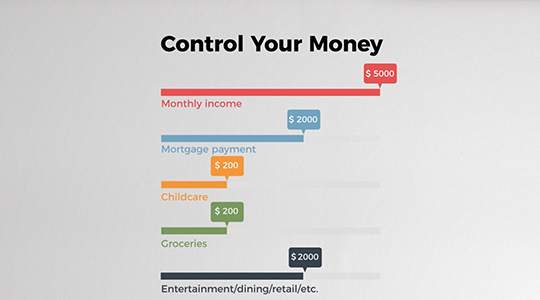

Budgeting.

Oregon High School Standard 36: Identify and explain strategies for creating a budget that balances income and expenses and encourages saving for emergencies and long-term financial goals, such as retirement.

Creating a budget (and sticking to it)

Length: 15 minutes

Using a short video and two interactive exercises, students will learn how to create and why you need a personal budget.

Creating a financial plan for your priorities and goals

Length: 20 minutes

Students will learn how personality factors into financial success, how to set effective financial goals, and more.

Setting up an emergency fund

Length: 30 minutes

Students will learn what an emergency fund is used for, why it’s important, how much to save, ways to grow the emergency fund faster, and more.

Making spending decisions

This activity helps students to make informed spending choices through the PACED decision-making model.

Creating a buying plan

In this exercise, students will create buying plans for two big-ticket items they may purchase in the future.

Budgeting for a fun trip or event

Students will work with a partner to plan a budget for an overnight trip to a city and reflect on the planning and budgeting process as a way to manage money.

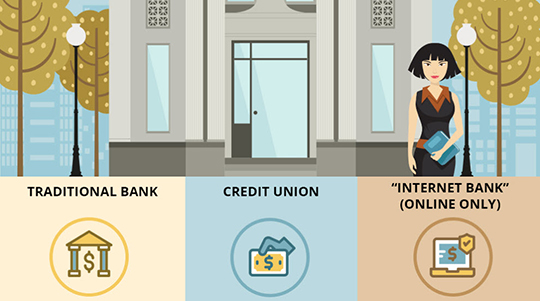

Financial institutions.

Oregon High School Standard 34: Identify financial institutions in the community and their purpose (such as banks, credit unions, consumer/business loans, deposit insurance, investments/trust services, non-traditional banking).

Banking with financial institutions

Length: 15 minutes

Teach students about different types of financial institutions and basic money managing strategies using checking and savings accounts.

How to choose the best bank for your personal finances

Length: 2 minutes

This article helps students understand different factors and options to consider when deciding on a financial institution.

Banks and credit unions

Length: 90-120 minutes (up to 2 class periods)

Students learn about banks and credit unions and evaluate a local bank and credit union to determine which one would be better suited to their needs.

Services beyond checking and savings

Length: 3 minutes

This video reviews services offered by financial institutions (beyond checking and savings) to help people manage, protect and grow their money.

Fraud protection.

Oregon High School Standard 32: Evaluate how consumers can protect themselves from fraud, identity theft, predatory lending, bankruptcy and foreclosure.

Protecting yourself from identity theft and scams

Length: 20 minutes

This course helps students learn how to assess their risk for identity theft or fraud, practice safe behavior online and identify and avoid scams and threats.

Cybersecurity and personal finance: identity theft

Length: 90-120 minutes (up to 2 class periods)

Students will learn the importance of protecting themselves from identity theft and determine how this relates to fraud.

Getting out of debt (and avoiding it in the future)

Length: 45 minutes

In this course, students will learn about types of debt, how to recognize and avoid debt relief scams, strategies for getting out of debt, and more.

How to avoid foreclosure

Length: 4 minutes

This video explains foreclosure and discusses the most common solutions that people seek out to avoid losing their home.

Quick-read articles about fraud protection.

- Common types of scams

This article from the Consumer Financial Protection Bureau outlines some of the most common types of scams and includes links to other articles with more details about each scam. - How can I protect myself from fraud?

This article from the Consumer Financial Protection Bureau offers steps students can take to protect themselves and others from fraud and scams. The article includes links to guides and other resources that identify the most recent known scams. - Why declare bankruptcy if you're not broke?

This article defines the different types of bankruptcies and explains the benefits, drawbacks and scenarios for considering each type.

Insurance.

Oregon High School Standard 31: Explain and analyze the kinds and costs of insurance as a form of risk management (e.g., auto, health, renters, home, life, disability).

Overview and concept of insurance

Length: 10 minutes

Students will learn about the concept of insurance and play a Kahoot! game. Note: students will need a Kahoot login to access the interactive quiz.

How insurance markets pool risk

Length: 60 minutes

Using group and individual activities, students will be able to explain how insurance markets pool the risk associated with individual drivers.

Assessing your insurance needs

Length: 45 minutes

Students will learn about basic insurance terms, why insurance is needed, how insurance safeguards their financial future, and more.

Everything you need to know about insurance

Length: 7 minutes

This article explains how insurance minimizes financial liability in the case of a catastrophe and provides peace of mind.

Long-term care insurance

Length: 10 minutes

In this article, students will learn about long-term care insurance, the costs involved, what to consider before purchasing, and more.

Understanding health insurance

Length: 35 minutes

This course helps students understand how health insurance works, the basic components of a healthcare plan, why they need health insurance, and more.

Loans.

Oregon High School Standard 37: Compare and contrast the various types of loans available, how to obtain them and the function of compounding interest, and explain the costs and benefits of borrowing money for post-secondary education.

Borrowing smart and preparing for higher education

Length: 20 minutes

This course provides students with information about federal student loan basics, PLUS loans, how to use the NSLDS, loan fees and interest, and more.

Repaying your student loans

Length: 18 minutes

Students will learn how to use the NSLDS, options for student loan repayment, strategies for managing student loan debt, deferment and forbearance, and more.

Buying a home and understanding mortgages

Length: 18 minutes

Students will learn about the mortgage application process, steps and timeline involved in buying a home, calculating how much home they can afford, and more.

Buying or leasing a car

Length: 35 minutes

Students will learn how to research vehicles, assess their car budget, assess their wants versus needs in a car, insurance considerations, ownership costs, and more.

Taxes.

Oregon High School Standard 38: Identify goods and services funded through local taxes and assess the effects of taxes on personal income.

Tic, tac, taxes

Length: 60 minutes (about 1 class period)

Students will be able to understand the reason for taxes and evaluate which goods and services are provided by business and which by governments.

Understanding your paycheck and W2

Length: 18 minutes

Students will learn how different types of workers are paid, how to decode their paycheck, types of employment forms, how taxes affect their paycheck, and more.

Additional tax resources.

- Paycheck Analyzer

This tool helps students calculate “take home” pay in order to understand how payroll taxes and deductions affect a paycheck. - Article: Most common taxes

This article reviews common taxes – such as income tax, taxes on property and goods, and estate and inheritance taxes – and how they can impact individuals.

External Factors.

Oregon High School Standard 39: Analyze how external factors such as marketing and advertising techniques might influence spending and saving decisions.

Be an ad detective.

Length: 60 minutes (about 1 class period)

Students search for new places where advertisers promote their products. They also investigate tools used by advertisers to develop brand awareness.

Get resources and class activities

Additional articles about influence and spending.

- How social media sites make money

This article shares how social media sites make money off consumers, describes the concept of data mining, and reviews how students can protect their privacy. - Stop emotional spending

Although some students might describe it as “retail therapy,” it’s more commonly known as emotional spending. This article shares eight ways to help curb these habits. - How to avoid impulse spending in college

This article encourages students to be thoughtful with their spending and shares tips such as creating a budget, stopping online browsing and leaving credit cards at home.

Investments.

Oregon High School Standard 35: Compare and contrast different investment options in weighing risk versus return to meet financial goals for long- term investing.

All saving choices involve risk

Length: 20 minutes

In this lesson plan, students evaluate various alternatives for saving money and learn the risks involved with each choice.

Investing to build wealth

Length: 30 minutes

Students will learn about basic investing terms and principles, general strategies, the balance of risk and return, and more.

Planning for retirement

Length: 35 minutes

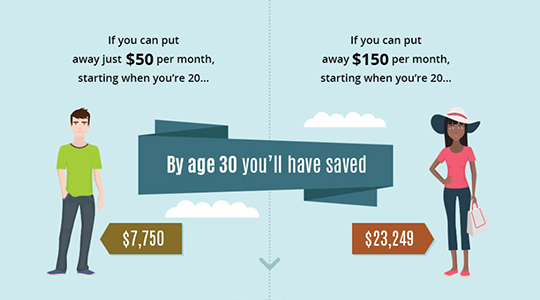

Students will learn about the importance of planning early for retirement, how compound interest works, evaluating their own retirement readiness, and more.

We value your insight and feedback.

We strive to provide valuable resources to help you meet your curriculum goals. We will continue to add more resources covering additional financial literacy state standards and competencies.