Financial education for teaching in Washington

Meet your financial literacy curriculum goals.

The courses, resources and tools provided on this page have been selected by OnPoint to support educators building a curriculum that corresponds with the State of Washington K-12 Financial Literacy Competencies. Select a link below to jump to the individual competency you would like to explore.

Spending and saving

Washington K-12 Competency 1: Students will apply strategies to monitor income and expenses, plan for spending, and save for future goals.

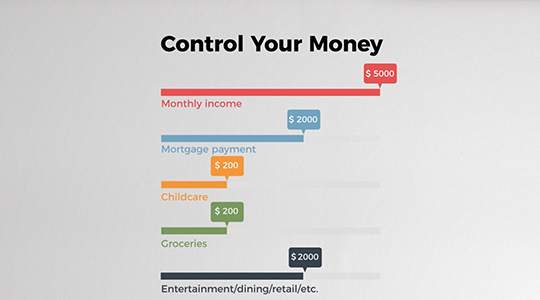

Creating a budget (and sticking to it)

Length: 15 minutes

Using a short video and two interactive exercises, students will learn how to create and why you need a personal budget.

Creating a financial plan for your priorities and goals

Length: 20 minutes

Students will learn how personality factors into financial success, how to set effective financial goals, and more.

Setting up an emergency fund

Length: 30 minutes

Students will learn what an emergency fund is used for, why it’s important, how much to save, ways to grow the emergency fund faster, and more.

Making spending decisions

This activity helps students to make informed spending choices through the PACED decision-making model.

Creating a buying plan

In this exercise, students will create buying plans for two big-ticket items they may purchase in the future.

Budgeting for a fun trip or event

Students will work with a partner to plan a budget for an overnight trip to a city and reflect on the planning and budgeting process as a way to manage money.

Credit and debt

Washington K-12 Competency 2: Students will develop strategies to control and manage credit and debt.

Using credit cards responsibly

Length: 20 minutes

Students will learn about how to manage credit card payments, how credit card companies make money, how to understand important rate information, and more.

Understanding credit reports and scores

Length: 12 minutes

Students will learn about the different types of credit, ways to manage credit scores, how to read a credit report, the effects of bad credit, and more.

Mastering credit and optimizing your score

Length: 20 minutes

Students will learn the difference between good debt and bad debt, what is considered an appropriate debt load, strategies for using credit effectively, and more.

Employment and income

Washington K-12 Competency 3: Students will use a career plan to develop personal income potential.

Understanding the reason for taxes

Length: 20 minutes (Grade: 6-8)

Students will learn about the reasons for taxes, while evaluating which goods and services are provided by businesses versus governments.

Maximizing earning potential and career development

Length: 15 minutes

Students will learn how to craft a solid resume, how to enhance your value at work, when it’s appropriate to ask for a raise, and more.

Understanding your paycheck and W2

Length: 18 minutes

Students will learn how different types of workers are paid, how to decode their paycheck, how taxes affect their paycheck, and more.

Borrowing smart and preparing for higher education

Length: 20 minutes

This course provides students with information about federal student loan basics, PLUS loans, how to use the NSLDS, loan fees and interest, and more.

Investing

Washington K-12 Competency 4: Students will implement a diversified investment strategy that is compatible with personal financial goals. Students will use a career plan to develop personal income potential.

All saving choices involve risk

Length: 20 minutes

In this lesson plan, students evaluate various alternatives for saving money and learn the risks involved with each choice.

Investing to build wealth

Length: 30 minutes

Students will learn about basic investing terms and principles, general strategies, the balance of risk and return, and more.

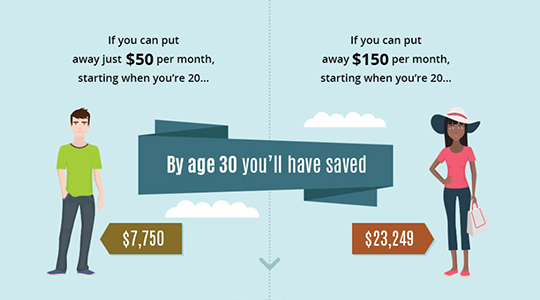

Planning for retirement

Length: 35 minutes

Students will learn about the importance of planning early for retirement, how compound interest works, evaluating their own retirement readiness, and more.

Financial decision making

Washington K-12 Competency 6: Students will apply reliable information and systematic decision-making to personal financial decisions.

Selecting financial products and services.

Length: 5 minutes

This guide, will help students consider and select different products and services based on their particular financial needs.

Download and share this guide

Additional decision making resources

- Infographic: The cost of applying to college

This resourceful infographic gives an overview of costs related to the college application process and helps students prepare for expenses associated with standardized tests, college visits, application fees and more. - Article: Community college or university

This article shares insights about choosing between a community college and a university and reviews a number of factors students should consider. - Worksheet: Create a budget

Risk management and insurance

Washington K-12 Competency 5: Students will apply appropriate and cost-effective risk management strategies.

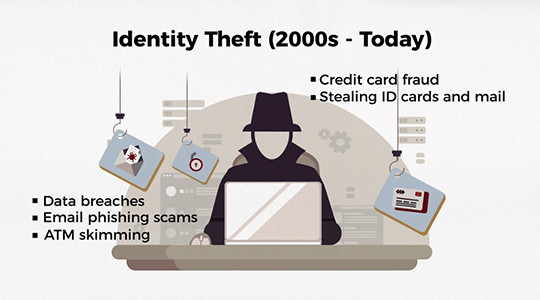

Cybersecurity and personal finance: identity theft

Length: 90-120 minutes (up to 2 class periods)

Students will learn the importance of protecting themselves from identity theft and determine how this relates to fraud.

Protecting yourself from identity theft and scams

Length: 20 minutes

This course helps students learn how to assess their risk for identity theft or fraud, practice safe behavior online and identify and avoid scams and threats.

Assessing your insurance needs

Length: 45 minutes

Students will learn about basic insurance terms, why insurance is needed, how insurance safeguards their financial future, and more.

Getting out of debt (and avoiding it in the future)

Length: 45 minutes

In this course, students will learn about types of debt, how to recognize and avoid debt relief scams, strategies for getting out of debt, and more.

Additional risk management resources

- Article: Common types of scams

This article from the Consumer Financial Protection Bureau outlines some of the most common types of scams and includes links to other articles with more details about each scam. - Article: How can I protect myself from fraud?

This article from the Consumer Financial Protection Bureau offers steps students can take to protect themselves and others from fraud and scams. The article includes links to guides and other resources that identify the most recent known scams. - Article: Why declare bankruptcy if you're not broke?

This article defines the different types of bankruptcies and explains the benefits, drawbacks and scenarios for considering each type. - Video: How to avoid foreclosure

This four-minute video explains foreclosure and discusses the most common solutions that people seek out to avoid losing their home. - Article: Everything you need to know about insurance

This article explains how insurance minimizes financial liability in the case of a catastrophe and provides peace of mind. - Interactive course: Understanding health insurance

This course helps students understand how health insurance works, the basic components of a healthcare plan, why they need health insurance, and more. - Article: Long-term care insurance

In this article, students will learn about long-term care insurance, the costs involved, what to consider before purchasing, and more.

We value your insight and feedback.

We strive to provide valuable resources to help you meet your curriculum goals. We will continue to add more resources covering additional financial literacy state standards and competencies.