Signature Visa® with Rewards Credit Card

Earn 3X points for travel, 2X points for dining, and 1.25X points on everything else for every $1 you spend.

Unlimited points & bonus offer

Get 3 points for every purchase on travel, 2 points on dining, and 1.25 points on everything else for every $1 you spend.

Low introductory APR offer

2.99% introductory APR for 6 months from account opening and 4.99% introductory APR on balance transfers for 12 months from account opening.

Get 10,000 bonus points when you spend at least $1,000 on your new card within the first 90 days.

Rates

Interest rates and charges | Introductory Annual Percentage Rate (APR) | Annual Percentage Rate (APR)1 |

|---|---|---|

Rates Effective: 07-09-2025 See important information about rates and fees Learn more about Signature Visa® with rewards1 APR will vary with the market based on the prime rate. How to avoid paying interest on purchases: Your due date is at least 25 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the due date each month. We will begin charging interest on Cash Advances and Balance Transfers on the transaction date. For credit card tips from the Consumer Financial Protection Bureau: To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at https://www.consumerfinance.gov/learnmore. How we will calculate your balance: We use a method called “average daily balance” (including new purchases). See your account agreement for more details. Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your account agreement. | ||

Interest rates and charges Purchases | Introductory Annual Percentage Rate (APR) 2.99% introductory APR for 6 months from account opening | Annual Percentage Rate (APR)1 14.25% - 24.75% depending on your creditworthiness |

Interest rates and charges Balance transfers | Introductory Annual Percentage Rate (APR) 4.99% introductory APR on balance transfers for 12 months from account opening | Annual Percentage Rate (APR)1 16.25% - 26.75% depending on your creditworthiness |

Interest rates and charges Cash advances | Introductory Annual Percentage Rate (APR) N/A | Annual Percentage Rate (APR)1 16.25% - 26.75% depending on your creditworthiness |

Rewards information

Earning points

Earn 3 points on every $1 spent on travel. Earn 2 points for every $1 spent on dining. Earn 1.25 points on everything else.

Redeeming points

Redeem $0.01 per point (e.g., 5,000 points earns $50). Points never expire! View and redeem your points at www.curewards.com, in Digital Banking, or by calling 800.900.6160 for assistance.

Using your points

Points can be put towards any of the following from the CU Rewards website:

- Airfare, hotels and car rentals

- Vacations and cruises

- Electronics

- Gift cards

- Housewares

- Jewelry

- And more merchandise

Get the convenience, flexibility and security you need with an OnPoint Visa® credit card.

Freeze or replace your card

If your card is lost or stolen, you can freeze it right from your smartphone or laptop. When you need a replacement card in a pinch, we’ll ship you a new one right away.

Transaction alerts

Set up alerts to monitor unusual activity and purchases.

Overdraft protection

Protect yourself from overdrafts and get more peace of mind by linking your credit card.

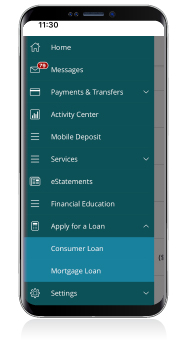

Apply for and manage your account

Get the convenience, flexibility and security you need with an OnPoint Visa® credit card.

Looking for account information?

Activate your card, enroll in online banking, pay your bill, check your account, and more.

Manage your account

Apply for your OnPoint credit card today

Credit card FAQs

Browse or search all Credit card FAQs.

Make more possible with your OnPoint Visa.

Get started today.

Apply onlineStop by an OnPoint branch.

Find a nearby location or ATMApply at your local branch.

Schedule a branch appointmentDisclosures

*APR=Annual percentage rate

All OnPoint credit cards are subject to credit approval. The credit union makes loans and extends credit without regard to race, color, religion, national origin, sex, handicap, or familial status. Credit card benefits such as “Rewards” are not deposits of OnPoint Community Credit Union, are not insured by the NCUA and are not guaranteed by OnPoint Community Credit Union.

Signature Visa with Rewards

All terms, including APRs and fees, may change as permitted by law and the OnPoint Visa Signature Credit Card Agreement. For more information regarding all the extra benefits offered, view the OnPoint Signature Visa with Rewards Guide to Benefits.

- Subject to conditions in the Visa Credit Card Agreement.

- Purchase airline tickets with your OnPoint Visa card and you and your eligible family members are automatically covered.

- Purchase your entire common carrier ticket to your Visa Signature card and your checked or carry-on luggage is covered up to $3,000 if lost or stolen. Receive up to $2,000 in coverage for your cancelled trip due to death, accidental bodily injury, or physical illness; or due to carrier default. Certain restrictions, limitations, and exclusions apply. Details accompany your new account materials.

- Get convenient towing and locksmith referral services in the United States and Canada, available 24 hours a day, 7 days a week. Certain restrictions, limitations, and exclusions apply. Details accompany your new account materials.

- Up to one (1) additional year on warranties of three (3) years or less when you purchase an eligible item entirely with your eligible Visa Signature card.

- Receive up to $2,500 in coverage for emergency treatment if you become sick or accidentally injured while traveling on a trip purchased entirely on your Visa Signature card. Certain restrictions, limitations, and exclusions apply.

*By submitting this form, you agree to OnPoint’s collection and use of the information you provide in accordance with our privacy notice and online privacy policy available here. You also confirm that any information you submit is your own and that you are at least 18 years of age.