Join your local community credit union

Get more from OnPoint.

It’s been nearly 90 years since a handful of schoolteachers joined together to form our credit union. They didn’t do it for profit. They did it to help one another. After all, that’s what community is all about.

We’re a local community credit union empowering you to get the most from life. When you want to talk to someone about your finances, there’s no better way than to meet in person. That’s why we’re expanding our coverage while national banks are closing branches.

Excellent rates & value

As a local community credit union, we’re in it for people—not profit. That’s why we offer lower rates and better value for our members.

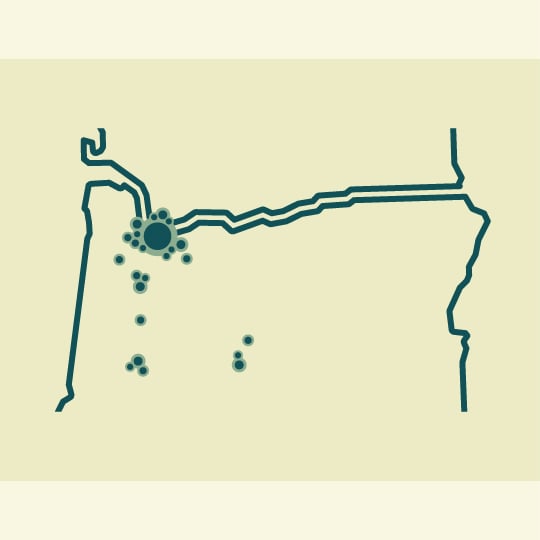

57 local branches

Having local branches throughout Oregon and SW Washington makes it easy to get in, get out and get back to your life.

40,000+ ATMs

Use your free Visa® debit card1 and enjoy easy access to your money with a nationwide network of OnPoint, CO-OP and MoneyPass ATMs.

Secure digital banking

Advanced digital banking allows people and businesses access to banking from anywhere. Anywhere you go, your money goes with you.

Who can join—membership eligibility.

We’re excited you’re considering becoming an OnPoint member, and with 57 branches in Oregon and SW Washington, joining has never been easier!

You’re eligible for membership if you meet any one of the following criteria:

Oregon

You live or work in any of the counties we serve, or you’re a family member of a person who is eligible for OnPoint membership. The 28 counties we serve in Oregon: Benton, Clackamas, Clatsop, Columbia, Coos, Crook, Curry, Deschutes, Douglas, Gilliam, Hood River, Jackson, Jefferson, Josephine, Klamath, Lane, Lincoln, Linn, Marion, Morrow, Multnomah, Polk, Sherman, Tillamook, Wasco, Washington, Wheeler, or Yamhill.

Washington

You live, work, worship or go to school in any of the counties we serve, or you’re a family member of a person who is eligible for OnPoint membership. The 2 counties we serve in Washington: Clark and Skamania.

Open an account online

What you'll need to apply online:

- Be a legal U.S. resident

- Be at least 18 years old (To open a youth membership, please visit an OnPoint branch.)

- Have a Social Security number

- Have a debit or credit card to fund your account(s)

- Have a government issued ID (Driver's License, State ID card, Passport. Permanent Resident Card, Military ID card)

Credit unions are different. OnPoint takes it further.

People are the Point.

Money without people is just money. It doesn’t roll up its sleeves to get things done. It doesn’t have a story, or dream big. OnPoint understands that it takes people to run a business, or turn a house into a home. And it takes people to build and support a thriving community.

People helping people.

We live in an inspiring community full of remarkable people and organizations working every day to make it special. We’re a member-owned, local community credit union empowering you to get the most out of your life through personalized banking service, comprehensive financial solutions and community impact.

People are the Point.

Become a member today.

Open a business membership with OnPoint.

Your business banking partner should be as focused on your future as you are—we know that you wear a lot of hats, so we do what we can to help make running your business as smooth as possible. With custom-tailored financing and easy-to-use tools, OnPoint makes banking easier, so you can get back to business.

Review required documents for opening a Business Membership in Oregon and Washington. We look forward to working with you.

OnPoint vs. banks

Type of organization

Type of organization

Who can join

Who can join

Invested in

Invested in

Deposits federally insured by

Deposits federally insured by

Governance

Governance

Interactions with like financial institutions

Interactions with like financial institutions

OnPoint

Type of organization

Not-for-profit – Fewer fees, better rates

As a not-for-profit financial cooperative, we return our profits to our members in the form of better rates, lower fees and greater service.

Who can join

Members

OnPoint’s membership is open to anyone in the communities we serve, including the family of eligible members.

Invested in

Community and members

We serve the needs of our membership and community by investing our non-interest income and interest from loans in local organizations working to make a difference.

Deposits federally insured by

NCUA insured ($250k)

Your deposits are insured by the National Credit Union Administration (NCUA) and are backed by the full faith and credit of the United States government.

Governance

Member owned

Every OnPoint member has a voice. Our Board of Directors are directly elected by members and offer guidance and expertise that benefit our entire membership base.

Interactions with like financial institutions

Cooperative

Credit Unions are financial cooperatives. That means we work together toward one common goal—helping our members prosper.

Banks

Type of organization

For-profit – More fees, worse rates

Traditional banking institutions primarily focus on generating profits for their shareholders with no added benefit to their customers.

Who can join

Customers

You cannot join a bank, but anyone can be a customer.

Invested in

Generating revenue

Banks use the income they generate from fees, interest, business accounts and investments to increase their shareholders’ earnings.

Deposits federally insured by

FDIC insured ($250k)

At a bank, your deposits are insured by the Federal Deposit Insurance Corporation and are backed by the full faith and credit of the United States government.

Governance

Shareholder owned

Banks are governed by their shareholders, voting rights depend on the number of shares you own leaving regular customers out of decisions.

Interactions with like financial institutions

Competitive

Banks are competitive. They compete with one another for your business and see you only as a number.

Better banking, more impact. Make our credit union your credit union today.

Disclosures

- The first card is free, the first replacement each year is free, and subsequent card replacements will incur a $5 card replacement fee.

If you would prefer to submit your application via mail, please contact us at 800.527.3932.

Consumer Membership & Account Agreement

Business Membership & Account Agreement