Credit cards

Local credit cards accepted worldwide.

It’s never been easier to find a credit card that fits your lifestyle, all from your local community credit union. Whether you’re spending locally, buying online, or traveling the world, you can find credit card options for earning rewards or cash back on all of your purchases with OnPoint.

Signature Visa with Cash Back Rewards

Earn 2% cash back on all purchases. Spend $1,000 on the card within the first 90 days to receive a $100 bonus.

There’s no limit on rewards, and cash back rewards are automatically deposited every year.

Must qualify for OnPoint Rewards and have an open checking account.

No annual fee.

Signature Visa with Rewards

Earn 3X points for travel, 2X points for dining, and 1.25X points on everything else for every $1 you spend.

Get 10,000 bonus points when you spend at least $1,000 on your new card within the first 90 days.

Points never expire.

No annual fee.

Platinum Visa with Rewards

Earn 1 point for every $1 you spend.

Get 5,000 bonus points when you spend at least $500 on your new card within the first 90 days.

Unused points expire after four years.

No annual fee.

Platinum Visa

Take advantage of low variable rates.

Best card option for those with lower credit scores.

No annual fee.

The freedom to choose what’s best for you.

With all OnPoint cards, you’ll get:

- A low variable rate

- Zero fraud liability

- Online access & 24-hour support

- Travel and accident insurance

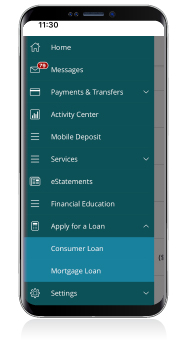

Spend securely without worrying about how much cash you have on hand or even get a cash advance when you need it. Pay your balance now or later and track your spending online each month using OnPoint’s Digital Banking and mobile app.

Rates

Interest rates and charges | Introductory Annual Percentage Rate (APR) | Annual Percentage Rate (APR)1 |

|---|---|---|

Rates Effective: 12-16-2025 See important information about rates and fees Learn more about Signature Visa® with cash back rewards1 APR will vary with the market based on the prime rate. How to avoid paying interest on purchases: Your due date is at least 25 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the due date each month. We will begin charging interest on Cash Advances and Balance Transfers on the transaction date. For credit card tips from the Consumer Financial Protection Bureau: To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at https://www.consumerfinance.gov/learnmore. How we will calculate your balance: We use a method called “average daily balance” (including new purchases). See your account agreement for more details. Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your account agreement. | ||

Interest rates and charges Purchases | Introductory Annual Percentage Rate (APR) 2.99% introductory APR for 6 months from account opening | Annual Percentage Rate (APR)1 13.75% - 24.25% depending on your creditworthiness |

Interest rates and charges Balance transfers | Introductory Annual Percentage Rate (APR) 4.99% introductory APR on balance transfers for 12 months from account opening | Annual Percentage Rate (APR)1 15.75% - 26.25% depending on your creditworthiness |

Interest rates and charges Cash advances | Introductory Annual Percentage Rate (APR) N/A | Annual Percentage Rate (APR)1 15.75% - 26.25% depending on your creditworthiness |

Interest rates and charges | Introductory Annual Percentage Rate (APR) | Annual Percentage Rate (APR)1 |

|---|---|---|

Rates Effective: 12-16-2025 See important information about rates and fees Learn more about Signature Visa® with rewards1 APR will vary with the market based on the prime rate. How to avoid paying interest on purchases: Your due date is at least 25 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the due date each month. We will begin charging interest on Cash Advances and Balance Transfers on the transaction date. For credit card tips from the Consumer Financial Protection Bureau: To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at https://www.consumerfinance.gov/learnmore. How we will calculate your balance: We use a method called “average daily balance” (including new purchases). See your account agreement for more details. Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your account agreement. | ||

Interest rates and charges Purchases | Introductory Annual Percentage Rate (APR) 2.99% introductory APR for 6 months from account opening | Annual Percentage Rate (APR)1 13.75% - 24.25% depending on your creditworthiness |

Interest rates and charges Balance transfers | Introductory Annual Percentage Rate (APR) 4.99% introductory APR on balance transfers for 12 months from account opening | Annual Percentage Rate (APR)1 15.75% - 26.25% depending on your creditworthiness |

Interest rates and charges Cash advances | Introductory Annual Percentage Rate (APR) N/A | Annual Percentage Rate (APR)1 15.75% - 26.25% depending on your creditworthiness |

Interest rates and charges | Introductory Annual Percentage Rate (APR) | Annual Percentage Rate (APR)1 |

|---|---|---|

Rates Effective: 12-16-2025 See important information about rates and fees Learn more about Platinum Visa® with rewards1 APR will vary with the market based on the prime rate. How to avoid paying interest on purchases: Your due date is at least 25 days after the close of each billing cycle. We will not charge any interest on purchases if you pay your entire balance by the due date each month. We will begin charging interest on Cash Advances and Balance Transfers on the transaction date. For credit card tips from the Consumer Financial Protection Bureau: To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at https://www.consumerfinance.gov/learnmore. How we will calculate your balance: We use a method called “average daily balance” (including new purchases). See your account agreement for more details. Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your account agreement. | ||

Interest rates and charges Purchases | Introductory Annual Percentage Rate (APR) 3.99% introductory APR for 6 months from account opening | Annual Percentage Rate (APR)1 12.75% - 23.25% based on creditworthiness |

Interest rates and charges Balance transfers | Introductory Annual Percentage Rate (APR) 6.99% introductory APR on balance transfers for 12 months from account opening | Annual Percentage Rate (APR)1 14.75% - 25.25% based on creditworthiness |

Interest rates and charges Cash advances | Introductory Annual Percentage Rate (APR) N/A | Annual Percentage Rate (APR)1 14.75% - 25.25% based on creditworthiness |

Interest rates and charges | Introductory Annual Percentage Rate (APR) | Annual Percentage Rate (APR)1 |

|---|---|---|

Rates Effective: 12-16-2025 See important information about rates and fees Learn more about Platinum Visa®1 APR will vary with the market based on the prime rate. How to avoid paying interest on purchases: Your due date is approximately 25 days after the close of each billing cycle. We will not charge any interest on purchases if you pay your entire balance by the due date each month. We will begin charging interest on Cash Advances and Balance Transfers on the transaction date. For credit card tips from the Consumer Financial Protection Bureau: To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at https://www.consumerfinance.gov/learnmore. How we will calculate your balance: We use a method called “average daily balance” (including new purchases). See your account agreement for more details. Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your account agreement. | ||

Interest rates and charges Purchases | Introductory Annual Percentage Rate (APR) 3.99% introductory APR for 6 months from account opening | Annual Percentage Rate (APR)1 11.75% - 22.25% based on creditworthiness |

Interest rates and charges Balance transfers | Introductory Annual Percentage Rate (APR) 6.99% introductory APR on balance transfers for 12 months from account opening | Annual Percentage Rate (APR)1 13.75% - 24.25% based on creditworthiness |

Interest rates and charges Cash advances | Introductory Annual Percentage Rate (APR) N/A | Annual Percentage Rate (APR)1 13.75% - 24.25% based on creditworthiness |

Apply for and manage your account

Get the convenience, flexibility and security you need with an OnPoint Visa® credit card.

Looking for account information?

Activate your card, enroll in online banking, pay your bill, check your account, and more.

Manage your account

Apply for your OnPoint credit card today

Make more possible with your OnPoint Visa.

Get started today.

Apply onlineStop by an OnPoint branch.

Find a nearby location or ATMApply at your local branch.

Schedule a branch appointmentDisclosures

All OnPoint credit cards are subject to credit approval. The credit union makes loans and extends credit without regard to race, color, religion, national origin, sex, handicap, or familial status. Credit card benefits such as “Rewards” are not deposits of OnPoint Community Credit Union, are not insured by the NCUA and are not guaranteed by OnPoint Community Credit Union.

Signature Visa with Cash Back Rewards

To earn the $100 bonus this must be a new Visa relationship. Bonus does not apply to existing Visa loans that are transferred or converted to a Signature Visa with Cash Back Rewards card. To qualify for a Signature Visa with Cash Back Rewards card you must maintain qualifications for OnPoint Rewards. To qualify for OnPoint Rewards you must be an existing member of OnPoint Community Credit Union. If you are an existing OnPoint member and you do not yet have OnPoint Rewards, please visit your nearest branch or go to onpointcu.com/onpoint-rewards to see if you qualify. Cash back rewards are credited annually in November to your open OnPoint checking account. If you close your OnPoint checking account before rewards are paid, even if your Signature Visa with Cash Back Rewards loan is active, you will forfeit your rewards for that year. To be eligible for this bonus offer, credit card account must be open and not in default at the time of fulfillment. All terms, including APRs and fees, may change as permitted by law and the OnPoint Visa Signature Credit Card Agreement. For more information regarding all the extra benefits offered, view the OnPoint Signature Visa with Rewards Guide to Benefits.

Signature Visa with Rewards

All terms, including APRs and fees, may change as permitted by law and the OnPoint Visa Signature Credit Card Agreement. For more information regarding all the extra benefits offered, view the OnPoint Signature Visa with Rewards Guide to Benefits.

Platinum Visa and Platinum Visa with Rewards

All terms, including APRs and fees, may change as permitted by law and the OnPoint Visa Credit Card Agreement | Auto Rental Collision Damage Waiver Benefit.

- Subject to conditions in the Visa Credit Card Agreement.

- Purchase airline tickets with your OnPoint Visa card and you and your eligible family members are automatically covered.

- Purchase your entire common carrier ticket to your Visa Signature card and your checked or carry-on luggage is covered up to $3,000 if lost or stolen. Receive up to $2,000 in coverage for your cancelled trip due to death, accidental bodily injury, or physical illness; or due to carrier default. Certain restrictions, limitations, and exclusions apply. Details accompany your new account materials.

- Get convenient towing and locksmith referral services in the United States and Canada, available 24 hours a day, 7 days a week. Certain restrictions, limitations, and exclusions apply. Details accompany your new account materials.

- Up to one (1) additional year on warranties of three (3) years or less when you purchase an eligible item entirely with your eligible Visa Signature card.

- Receive up to $2,500 in coverage for emergency treatment if you become sick or accidentally injured while traveling on a trip purchased entirely on your Visa Signature card. Certain restrictions, limitations, and exclusions apply.

*By submitting this form, you agree to OnPoint’s collection and use of the information you provide in accordance with our privacy notice and online privacy policy available here. You also confirm that any information you submit is your own and that you are at least 18 years of age.