Digital system security

Browser requirements.

For best performance when accessing digital banking, we recommend using the most updated version of the supported browsers listed below. For Mobile Banking, we recommend you update your mobile operating system (iOS or Android) to the newest version available.

While other browsers may work, these supported browsers provide the highest level of security, accuracy and functionality. We also recommend you enable JavaScript and pop-up windows in your browser for certain features to function properly.

Recommended browsers.

- Google Chrome (version 139 or above)

- Safari (version 18.5 or above)

- Mozilla Firefox (version 140 or above)

- Microsoft Edge (version 138 or above)

Online and mobile banking.

These security features protect your information in online and mobile banking and help prevent unauthorized access to your accounts. You can also set up History Alerts to inform you when a certain check number posts or when transactions meet a certain amount you choose.

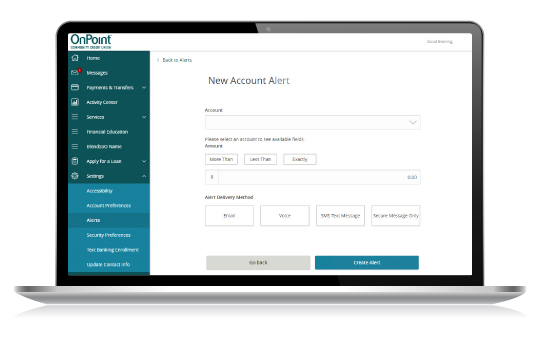

Account alerts.

Receive account alerts based on events such as when your balance falls below a threshold you’ve set or scheduled alerts that you receive on a regular basis.

To get started, log in to Digital Banking and select Settings from the main menu, then click Alerts.

- Use the “New Alert” drop-down and select “Account Alert.”

- Select an account and select either "Available Balance or "Current Balance."

- Select a comparison and enter an amount.

- Select a delivery method (Email, Voice, SMS Text Message or Secure Message Only).

- Choose a frequency to determine how often you want to be alerted.

- Click "Create Alert" to finish.

Encryption

OnPoint’s Digital Banking uses the most trusted Extended Validation certificate from Entrust and supports up to AES-256 bit encryption providing protection for all your online transactions.

Individual login

When you sign up for Online or Mobile Banking, we ask you to create your own unique Login ID and Password.

Intelligent authentication

Our system uses Secure Access Codes to validate your identity as an Online or Mobile Banking user before granting access to your accounts.

Timed log off

Online and Mobile Banking will end your session after a period of inactivity, reducing the risk of other people accessing your accounts should your computer be left unattended.