OnPoint’s community partnerships are fueled not only by financial support but by how our employees show their love for our community, which includes dedicating their time and expertise toward supporting financial wellness in the region. Earlier this year, we announced expanded partnerships with Financial Beginnings and Junior Achievement of Oregon and SW Washington, two outstanding local financial education-focused nonprofits. This deepened commitment to financial success includes our pledge to train 100 OnPoint employee volunteers over the next year to support these organizations. Our volunteers will help bring the programs to life for local schools and community groups, as they teach personal finance skills to promote self-sufficiency and empowerment for people of all ages.

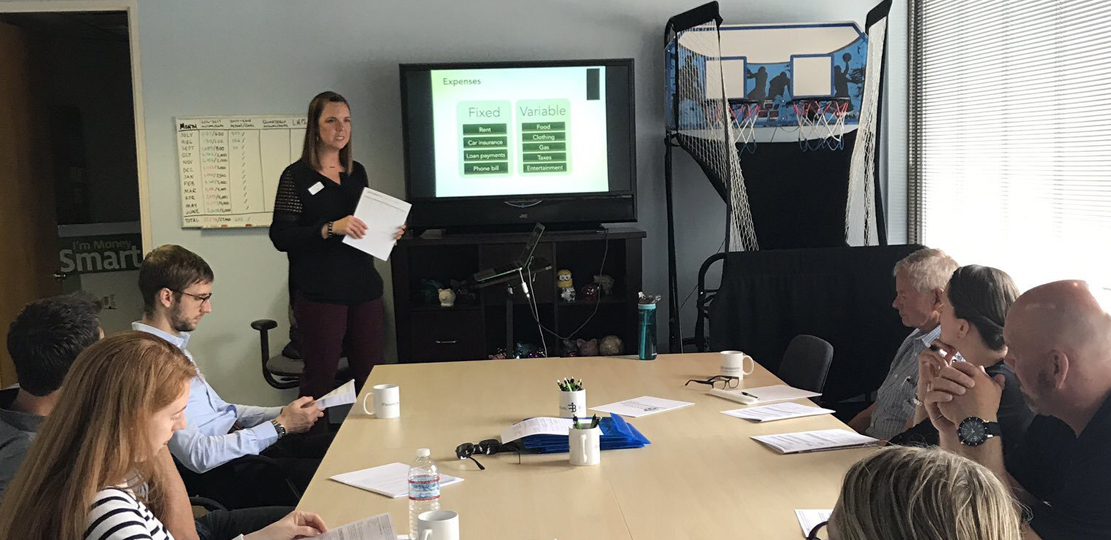

OnPoint’s corporate volunteer program encourages employees like Amber Kelly, Oregon City Branch Manager, to connect with members and the community. Amber has been a Financial Beginnings volunteer for nearly nine years. In 2018 alone, she spent almost 60 hours in the classroom, including regular work with women at the Clackamas County’s Correction Substance Abuse Program (CSAP). We asked Amber to share her experience.

First, please explain a bit more about your experience volunteering with Financial Beginnings.

I have volunteered for Financial Beginnings for around nine years, and I love it. It’s my passion to inform and educate as many people as possible about personal finance. I believe everyone can benefit from being empowered by this information. Unfortunately, I encounter so many people who never received basic financial education, and I’ve witnessed the negative impact it can have on their lives. Financial Beginnings provides great materials and information, and I really feel I am making a difference through teaching—it is one of the most fulfilling parts of my job.

What is the most meaningful part of your volunteer work?

I love to see how engaged the students are when I’m teaching. I look around the classroom and can see them putting the pieces together, setting financial goals and recognizing how to save more. I also feel lucky to have built so many great relationships. I often teach at a correctional facility, and I’ve had the opportunity to help many of the students open their first checking accounts. It’s rewarding to see students take the information I taught them and implement it in their lives.

OnPoint encourages employees by providing paid volunteer hours. What has this meant to you?

OnPoint’s support has given me the opportunity to do something meaningful. All of my teaching takes place during school hours, which are also work hours. Without OnPoint’s support, volunteering simply wouldn’t be possible. OnPoint has empowered me to give back, and as a manager, I’m able to do the same for my staff so that they too are inspired to volunteer their time and expertise.

What impact has your volunteer work had on other OnPoint employees?

I’ve had the opportunity to speak to several branches about my experience, so others can hear firsthand the kind of connection they can have with people in our community. I tell them that OnPoint team members are uniquely qualified to make a difference through this program. Because we work in the financial industry, it’s easy to take for granted our wealth of knowledge. I encourage my colleagues by letting them know they can have a significant impact, using the resources and skills they’ve built at OnPoint.

How has volunteering also benefitted your professional development?

Volunteering has given me a new sense of purpose in my work and shown me the bigger picture of OnPoint’s impact in the region we serve. My work at OnPoint is not simply a job—it’s a career. Beyond that, my work with Financial Beginnings has improved my communication skills. To be an effective teacher in the program, I have to be comfortable in front of an audience and be able to speak with authority and confidence—that’s a skillset that will benefit me in my career now and for years to come.

How does volunteering strengthen your connection to your community?

Volunteering for Financial Beginnings has made a huge difference in how connected I feel with my community. I run into kids I’ve taught years later; they often remember me and the information I shared. I see many of them come into the branch and open checking and savings accounts. It feels incredibly gratifying to see these students incorporating what I taught them and making sound financial decisions.

This year, OnPoint announced its increased commitment to financial education. What impact do you think this will have?

I am so excited to see the financial education volunteer program really grow and expand in this way. So few kids receive any type of financial education, and there is a huge need. Expanding the program is going to mean more kids will enter adulthood with an understanding of financial literacy basics like budgeting, how credit scores work and how to evaluate investment options.

What would you tell community members who are also interested in financial education?

I would highly encourage people to look into volunteer opportunities with Financial Beginnings. The rewards far outweigh the discomfort you may feel the first time you get up in front of a classroom. The most surprising parts for me were the amount of personal growth I achieved and the community connections I made—this experience can be one of the most fulfilling parts of your career.

You can learn more about volunteering with Financial Beginnings here.