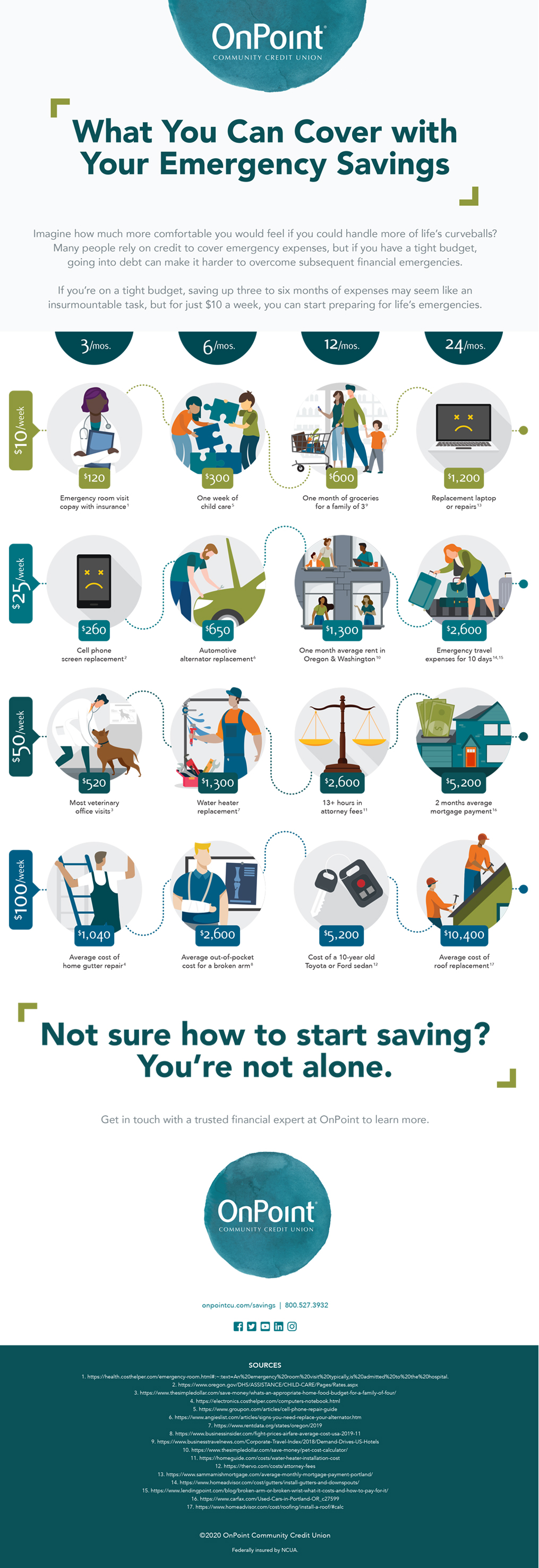

Do you have an emergency savings account to help you cover unpredictable costs or disruption to your income? If not, you’re not alone. Since these expenses are often unpredictable, it’s easy to delay saving for an emergency. Now more than ever, the benefit of an emergency fund is clear—helping to cover or off-set unexpected expenses, like a major injury, medical bills, a totaled vehicle or a lay-off. In these uncertain times, starting or growing your emergency fund can help you improve your financial security.

Most people have far less in their emergency fund than they need, and saving three to six months of living expenses can feel like an impossible task. It can be discouraging if you don’t think you can ever reach your emergency savings goal. The reality is that it all starts with consistently saving what you can. Emergencies are unpredictable and long-term goals may not provide comfort today. Our infographic can help encourage good saving habits by showing how your savings can add up and protect you from the unexpected both in the short- and long-term.