In the past, it was common to use cash and checks for daily transactions. People used credit cards less frequently, and debit cards were non-existent. Now, with swipes and digital transactions becoming the norm, we are more distant from our money than ever. This distance makes it easier to spend, which means it’s even more important to understand our finances.

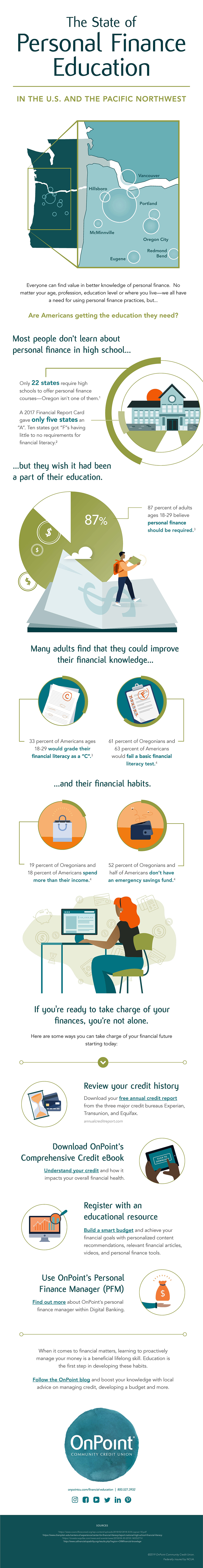

Unfortunately, most Americans would not pass a financial literacy test. A five-question financial literacy survey of Oregon residents showed that most were unable to answer more than three questions correctly.

However, our latest infographic shows that people living in the Pacific Northwest have a need and a desire to improve their financial literacy. Being financially literate requires that you gain the knowledge and skills necessary to spend money wisely. Understanding how to spend money wisely will empower you to make smart financial decisions for your situation. Financial literacy can help you:

- Save for retirement

- Create—and stick to—a budget

- Buy a home

- Choose insurance

- Manage your spending

- Invest

- Purchase a vehicle

- Save for higher education

- Manage debt

- Use a credit card

Our dedication to helping members achieve their financial goals extends beyond products and services. As a local credit union founded by teachers, we understand the value of education and are happy to provide high-quality financial education resources to our community at no cost.

Learn about “The State of Personal Financial Education” by downloading our latest infographic.