Financial health check

Building your financial fitness plan.

Progressing with your financial fitness goals starts with understanding where you are and deciding where you’d like to be. A financial health check isn’t all that different from how we treat physical fitness. For some, it seems to come easy. For others, it may take more discipline and planning. Our finances take many different shapes—but each of us has the power to improve.

No matter your starting point, OnPoint provides you with the tools to achieve sustainable financial wellness.

Start an emergency savings fund

Starting or growing your emergency fund can help you improve your financial security by covering or off-setting unexpected expenses, like a major injury, medical bills, a totaled vehicle, or a lay-off.

Prepare for a natural disaster

The Pacific Northwest is home to many potential natural disasters. By preparing for an emergency, you can reduce the fear, stress, uncertainty, and potentially the loss that comes with many disasters.

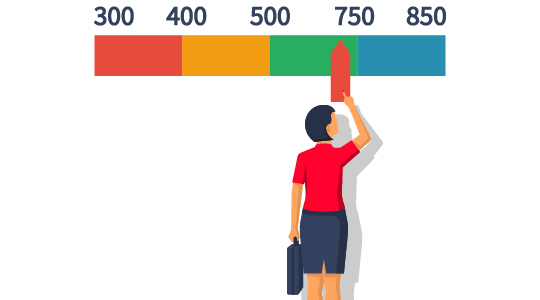

Give your credit a checkup

Just like visiting the doctor can boost physical wellness, understanding and periodically reviewing credit reports can help us make better financial decisions. Here’s what you need to know.

Commit to getting financially fit

In addition to physical fitness, a new year can also be the perfect time to focus on getting finances in tip-top shape. Being financially fit can offer freedom and stability while reducing money worries.

Why financial wellness is just as important as physical health.

Stress can have a lasting negative impact on your physical and mental health. If you’re experiencing stress, you may have trouble sleeping, increased overall fatigue, muscle aches and headaches. Stress can even cause your body to produce cortisol, a stress hormone that impairs your brain’s ability to create long-term memories. Addressing the stress you feel about money is a major part of achieving financial and physical wellness.

Learn more

Know more today. Enjoy more tomorrow. For free.

Your doctor recommends an annual physical, but how often do you perform a financial health check? Financial stress can negatively impact people of all backgrounds and income levels—the key to decreasing the negative impact of financial stress is proactively making incremental improvements. Test your knowledge and track your growth with digital courses from Enrich. Finally, financial education that helps you achieve your goals.

Sample courses from Enrich

Creating a budget

-Introductory-

Budgeting is a crucial component to your financial well-being and how to start building your budget based on your unique goals. You’ll also get tips to help find opportunities for spending less and reducing overall expenses.

Planning for retirement

-Intermediate-

Get guidance on long-term financial management, as well as an overview of the many retirement account options available. Then, develop a detailed financial assessment to help you evaluate your next steps to ensure a comfortable retirement.

Mastering credit

-Advanced-

Understand how to use credit wisely and gain debt management techniques to optimize your credit score. Discover how your debt, income, and other expenses relate to your overall credit health, and evaluate different types of credit and loans available.