Universities and colleges across the U.S. are moving students from lectures and labs to remote learning environments. Hundreds of institutions are closing their campuses indefinitely based on guidance from local health agencies and the Centers for Disease Control and Prevention’s Interim Guidance for Administration of U.S. Institutions of Higher Education.

Knowing which universities and colleges are closing and when they’re closing is difficult to pinpoint. Some educators, like Bryan Alexander, are managing their own college COVID-19 closure counts. It’s unlikely that any of the 4,000+ degree-granting higher education institutions offer a course in Expecting the Unexpected 101 – not yet at least. So, why not get a head start and help your college kids turn their uncertainties into real-life lessons? Having your college student at home doesn’t mean that education has to be on hold. This is your opportunity to discuss financial planning with your child.

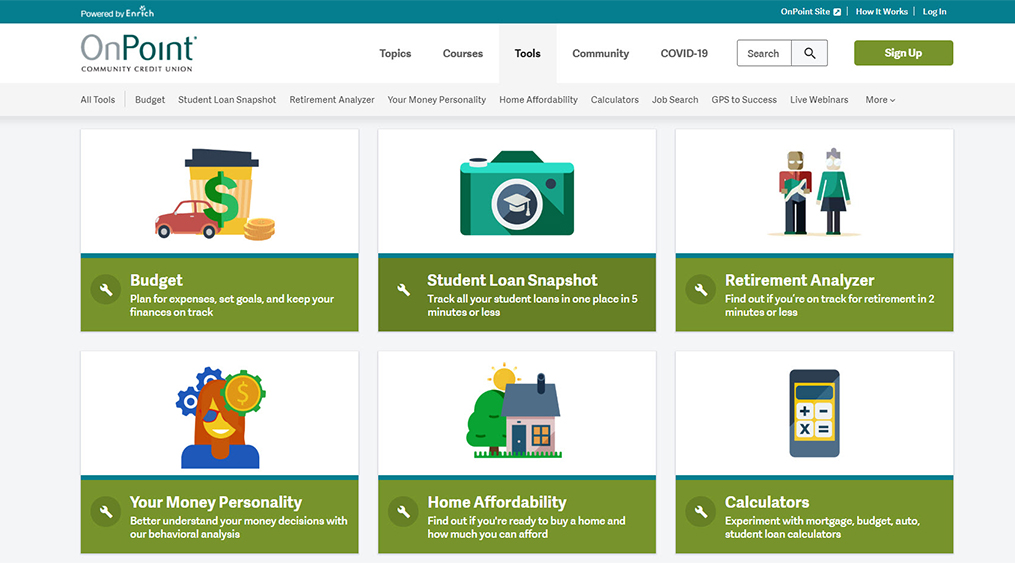

Here are a few personal financial resources to get them started.

Your Money Personality – Have them assess their views on money.

Your Money Personality is an interactive personalized assessment that walks users through a series of five categories of questions: Emotions, Outlook, Focus, Influence and Bonus. Taking the 10-minute survey gives the user access to a personalized and printable Behavior Finance Analysis eBook, complete with a table of contents. It’s just one of many customizable interactives available on Enrich, an all-in-one financial education platform to help users curate their financial learning. Users can explore courses and tools like financial aid coach videos and an education grant and scholarship search portal. There is something for everyone, not just young adults. Access to and enrollment in Enrich is free through OnPoint’s Financial Education portal.

Financial Planning for Young Adults – Suggest they audit a class for free.

The University of Illinois at Urbana-Champaign offers a 4-week online course to get young people in tune with their personal finances. This Massive Open Online Course (MOOC) is one of the thousands available through Coursera, an online learning conglomerate of colleges and universities. Through the free audit option, enrollees work through weekly modules with access to videos and readings. Topics include assessing one’s financial situation to considering a career in financial planning.

Repay student debt online tool – Help them pinpoint a payment plan.

The Consumer Financial Protection Bureau (CFPB), provides resources to get college students started on a plan to repay student loans. This CFPB online tool is a quick Yes-No quiz, generating responses and downloadable resources that best fit a student borrower’s situation. Sample letters addressing how to communicate with debt collectors, as well as links to learn more about repayment options—like Public Service Loan Forgiveness—are two of the resources available to users.

Higher education closures have pushed students out of dorms and away from campus resources. If your child is heading home, it could be an opportunity to talk about planning for the unexpected. Though financial awareness is but one factor in the equation of life, improved financial knowledge can be empowering to students during times of uncertainty and change. Taking this opportunity to learn more about finances can provide benefits that go well beyond their college experience.

Learn more about how OnPoint is leading financial education in our community.